Get Your Tax Return Filed Faster with These Online Services in Australia

Get Your Tax Return Filed Faster with These Online Services in Australia

Blog Article

Comprehending the Value of a Tax Return: How It Influences Your Financial Future

Comprehending the relevance of a Tax return prolongs beyond plain compliance; it serves as an essential tool in forming your financial trajectory. A detailed tax obligation return can affect important choices, such as finance eligibility and prospective cost savings using deductions and credit reports. Many people undervalue the ramifications of their tax obligation filings, typically neglecting the wealth-building possibilities they present.

Summary of Tax Returns

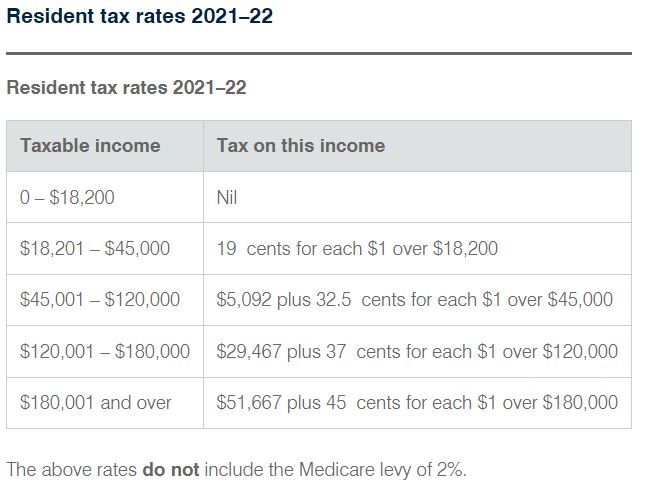

Income tax return are crucial records that people and businesses file with tax obligation authorities to report revenue, expenditures, and various other financial information for a details tax obligation year. These considerable kinds serve several functions, consisting of identifying tax responsibilities, asserting reductions, and examining eligibility for various tax credit reports. The main elements of an income tax return usually consist of income from all sources, adjustments to revenue, and a detailed failure of deductions and credit histories that can reduce overall taxed earnings.

For individuals, typical kinds include the internal revenue service Form 1040 in the USA, which describes incomes, passion, dividends, and other kinds of revenue. Businesses, on the other hand, might utilize the internal revenue service Type 1120 or 1065, depending on their structure, to report corporate earnings and expenses.

Submitting income tax return precisely and prompt is crucial, as it not just assures compliance with tax obligation laws but additionally influences future monetary preparation. A well-prepared tax return can give understandings into financial health, highlight areas for potential financial savings, and help with enlightened decision-making for both businesses and individuals. The complexities included necessitate a detailed understanding of the tax obligation code, making expert support frequently valuable.

Effect On Car Loan Qualification

Prompt and precise submission of income tax return plays an important function in identifying a person's or organization's eligibility for loans. Lenders frequently require recent income tax return as part of their assessment procedure, as they give a thorough introduction of revenue, financial security, and total financial wellness. This documentation assists lenders assess the borrower's ability to settle the financing.

For people, consistent revenue reported on income tax return can improve creditworthiness, leading to much more favorable lending terms. Lenders generally seek a steady revenue background, as fluctuating profits can increase issues about repayment capability. Likewise, for organizations, income tax return work as a substantial sign of success and capital, which are essential variables in protecting organization financings.

Furthermore, discrepancies or inaccuracies in tax returns may raise red flags for loan providers, potentially leading to lending rejection. As an outcome, maintaining exact records and filing returns in a timely manner is important for people and services aiming to boost their finance eligibility. To conclude, a well-prepared income tax return is not only a legal need but likewise a critical tool in leveraging monetary chances, making it essential for anybody taking into consideration a funding.

Tax Obligation Credit Scores and Deductions

Comprehending the subtleties of tax credit ratings and deductions is essential for maximizing monetary end results. Tax obligation credit reports straight minimize the quantity of tax obligation owed, while reductions reduced gross income. This difference is substantial; as an example, a $1,000 tax credit rating decreases your tax costs by resource $1,000, whereas a $1,000 deduction lowers your gross income by that quantity, which results in a smaller sized tax reduction depending upon your tax bracket.

Reductions, on the other hand, can be detailed or taken as a common deduction. Making a list of allows taxpayers to list eligible expenses such as home mortgage rate of interest and medical expenses, whereas the standard deduction provides a fixed reduction amount based upon declaring status.

Planning for Future Investments

Effective preparation for future investments is essential for constructing wide range and accomplishing economic goals. A well-structured financial investment technique can help people profit from prospective growth possibilities while additionally alleviating threats connected with market check over here fluctuations. Comprehending your tax return is a vital element of this preparation procedure, as it supplies insight right into your economic health and wellness and tax responsibilities.

In addition, knowing how financial investments might impact your tax scenario allows you to pick financial investment cars that straighten with your general financial method. Focusing on tax-efficient financial investments, such as long-lasting capital gains or community bonds, can boost your after-tax returns.

Typical Income Tax Return Misconceptions

Numerous my response people hold misconceptions about tax returns that can result in complication and expensive blunders. One widespread misconception is that submitting an income tax return is only needed for those with a significant revenue. Actually, even people with reduced revenues may be required to file, especially if they get approved for particular credit ratings or have self-employment revenue.

One more common misconception is the idea that getting a refund implies no taxes are owed. While reimbursements suggest overpayment, they do not absolve one from liability if taxes schedule - Online tax return. In addition, some believe that tax obligation returns are just essential throughout tax obligation season; however, they play an important function in financial planning throughout the year, impacting credit history and car loan eligibility

Numerous also believe that if they can not pay their tax obligation bill, they must stay clear of filing completely. While useful, it is essential for taxpayers to comprehend their distinct tax scenario and evaluation entries to validate compliance.

Resolving these misconceptions is essential for reliable monetary administration and preventing unnecessary issues.

Final Thought

To summarize, tax obligation returns act as a basic component of monetary management, affecting funding eligibility, discovering prospective financial savings through reductions and credit scores, and notifying tactical investment decisions. Ignoring the significance of precise income tax return declaring can lead to missed monetary chances and impede efficient monetary preparation. As a result, an all-inclusive understanding of tax obligation returns is vital for cultivating long-term monetary stability and enhancing wealth-building methods. Focusing on tax obligation return understanding can considerably boost total monetary wellness and future potential customers.

Tax obligation returns are essential papers that people and organizations file with tax obligation authorities to report income, expenses, and various other financial info for a details tax obligation year.Submitting tax returns properly and prompt is essential, as it not only assures conformity with tax obligation laws but likewise influences future economic planning. Nonrefundable credit scores can only lower your tax obligation to absolutely no, while refundable credit scores may result in a Tax refund exceeding your tax owed. Common tax credit ratings include the Earned Earnings Tax Obligation Credit Scores and the Child Tax Credit scores, both intended at sustaining family members and people.

Furthermore, some believe that tax returns are only crucial during tax obligation period; nevertheless, they play a crucial duty in financial planning throughout the year, impacting credit scores and car loan qualification.

Report this page